Despite PET's Virtues, There's Still Room for Improvement

By Bill Noone, Managing Editor of Packaging Network

Table of Contents

Entering Mature Stages

Invigorating an Age-Old Product

PET Not an End-all

The food and beverage industry is well aware of the tremendous inroads PET packaging has made in the past several years, as conversions from glass and other plastics to PET have abounded. End-users such as Kraft Foods, Dean Foods, Pepsi Cola and Campbell's Soup have embraced PET, using it for such innovative new product applications as Dean Food's recent NesQuik flavored milk relaunch.

What's not so obvious, however, is that there is still plenty of room for improvement in the versatile plastic package.

Despite the recent onslaught of PET packaging — for everything from beverages, to jellies, and even soups — members of an end-user panel speaking at PET Strategies 99 in Atlanta September 22-23, sponsored by Packaging Strategies, Inc., cautioned that PET's continued success still hinges on its ability to adapt to an ever-changing packaging marketplace.

Michael Payne, group manager, packaging development, Pepsi Cola reminded the roughly 300 conference attendees, who represented various cross-sections of the PET supply chain, why consumers like PET: they can clearly see the product, and the container is resealable, shatterproof and recyclable.

"PET-related initiatives comprise the majority of Pepsi's package innovation portfolio. Simply, consumers love PET bottles, and that's the reason we're in them," said Payne.

However, Payne, whose organization helped develop Pepsi's Grip and Claw PET beverage containers (he said Pepsi hopes to have further rollout of the 2-L Grip container, which has been slow to expand since its introduction in March 1998), spoke in terms of "evolution." "PET bottles must continue to evolve to sustain even a portion of its historical growth rate. Barrier properties are the key needs, with respect to carbon dioxide, oxygen and light wavelengths."

In fact, managing this evolutionary and even transformational process within the confines of the existing infrastructure, said Payne, is the greatest challenge facing the growth of PET as a beverage container.

He predicted that growth in the 8-oz to16-oz PET bottle sector "is inevitable," saying there are distribution channels and products where the popular 20-oz bottle may not be the right size. Pepsi currently is using a monolayer 12-oz bottle as part of a multipack, he said.

Entering Mature Stage

And although Kraft Foods is moving "full speed ahead with PET packaging initiatives," there is still room for improvement, said Frank Leigner, technology principal, Kraft Foods R&D.

"PET has been great, but it must be made better," said Leigner, who managed the glass-to-plastic conversion of all Kraft pourable salad dressings and now works in Kraft's Systems of the Future group, formed last year to centralize the organization's cross-functional research capabilities. "We're going from a growth stage to more of a mature stage in PET containers."

"We need to give consumers the same delivery at lower cost," urged Leigner in stating that better, more efficient package designs are needed for PET's continued growth. He added that innovative, different designs from what currently exist can also improve PET packaging.

Examples of new designs, he said, are "active packages" that utilize oxygen absorbers, such as bottles used for beer. "These bottles can even allow plastic to surpass glass by actually sucking oxygen out." Other innovations include adding aroma to a package, self-heating and/or self-cooling containers, and mold inhibitors.

There's also a need for a variety of systems improvements, said Leigner, who added that Kraft plans to partner with global suppliers to develop more effective packaging systems. Such improvements would include the development of blow-fill systems, which could eliminate shipping in the value chain; improved closure systems; less constraints on hot-filling; microwaveable hot-fill containers; and improved moisture barrier.

He'd also like to see inmold labeling at high speeds become more readily available and suggested that widemouth containers are "the last entrenched position for glass and food."

Leigner said that recent successes with ready-to-eat products like puddings and jellos, as well as ready-to-drink beverages, are causing Kraft to focus on rigid plastics in developing new items. "We're working on new products that will use PET."

Invigorating an Age-Old Product

Dean Foods found out that sometimes a change in packaging structure combined with a marketing push may be all that's needed to bring an existing product new life when it successfully launched its Milk Chugs in proprietary HDPE bottles. The much celebrated packaging innovation enabled the company to increase sales in that product line by 35%.

Now the Franklin Park, IL, dairy processor and distributor, which sells a full line of branded and private label products under the Dean's and other regional brand names, is at it again. This time Dean Foods has utilized PET to boost sales of extended shelf life (ESL) NesQuik flavored milks, formerly packaged in paperboard cartons. Ryan Foods, the wholly owned ESL subsidiary of Dean Foods Co., is licensed by Nestle USA to manufacture, sell, distribute and promote ESL NesQuik flavored milks.

NesQuik is Dean Foods' first venture into PET packaging, said Dr. Daniel E. Green, vice president of business development at Dean Foods. The company, he said, is anticipating sales jumps for NesQuik similar to those achieved for Chugs.

Utilizing an ESL plastic approach that employs Sidel Combi system technology, the NesQuik project is the first time Dean Foods is manufacturing PET in-house. Green said the 16-oz NesQuik full-shrink-labeled bottle, which has a 60-day shelf life, accommodates four SKUs – strawberry, chocolate, low-fat chocolate and banana – and offers an "upscale, proprietary package design that promotes the brand and meets consumer needs." The brightly colored labels incorporate small windows that allow the various colored milk products to show through, giving the product impressive shelf presence.

Although the benefits Dean Foods gained from the NesQuik PET project are impressive — twice the production speed over the previously used paperboard cartons, flexibility in package design, improved profitability, and an extended shelf life for a wider product line — the conversion to PET hasn't been painless.

Green said the increase in output has led to a variety of other production adjustments, and he sees six challenges Dean Foods must address if the company is to expand the use of PET in its current product mix:

1 – Dean needs more time and experience with PET.

2 – Integration with downstream packaging equipment and materials such as caps must be improved.

3 – Line speeds must increase while improving efficiency.

4 – Flexibility in changeovers must be optimized.

5 – There must be continued availability of PET resin and preforms at competitive prices.

6 – There must be a need for additional branding opportunities.

PET Not an End-all

PET may be an effective, versatile packaging material, but as Campbell Soup Co.'s Brad Menees, director global packaging, put it, "PET is not an end-all application."

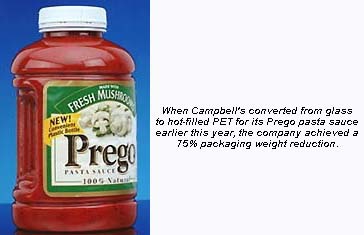

Campbell's has made great use of PET in the past year, converting its Prego pasta sauce and ready-to-serve soups from glass to PET. The new hot-filled widemouth pinch-grip 67-oz PET jar for Prego (from Schmalbech-Lubeca) replaces a glass container that weighed just over one pound, and its shelf life of slightly more than one year is actually a little better than the glass jar.

The ready-to-serve 32-oz soups — successfully test marketed starting in July 1998 — were just recently rolled out nationally. The recloseable multi-use application container, which can go from usage to the refrigerator, gives Campbell's a product that didn't previously exist, said Menees.

However, not every application is a match for PET, he suggested. "We look at PET as well as other types of packages." For example, Campbell's "Simply Home" soup line is in glass. Menees said PET did not fit the "homemade consumer perception" that Campbell's was trying to project. He said PET does not conjure up thoughts of "homemade" like the older, well established glass.

Barrier can be another strike against PET, said Menees. PET loses out on Campbell's Pace Picante sauce, which is packaged in a polypropylene EVOH barrier container.

One of Campbell's biggest challenges, he said, is matching the consumer expectation with the package type. "We'll look at any type of package," said Menees. "Decisions to change are consumer-driven. Consumers may not even know it's PET – they just know it's plastic."

For more information on PET Strategies 99: Packaging Strategies, Inc. Tel: 610-436-4220.